The path to financial independence is a journey paved with mindful decisions and strategic planning. Growing a solid financial foundation involves implementing prudent budgeting habits, diligently storing for the future, and deploying wisely to generate passive income. Moreover, diversifying your portfolio and managing risk effectively are crucial steps toward attaining lasting financial freedom.

- Establish a comprehensive budget that aligns with your monetary goals.

- Prioritize debt reduction to minimize interest payments and amplify your financial flexibility.

- Investigate diverse investment options that align with your risk tolerance and time horizon.

Remember that the journey to financial independence is ongoing. Regularly review your financial plan, adjust it as needed, and remain informed about market trends and economic movements.

Building Generational Wealth: A Legacy That Endures

Generational wealth accumulates over time, transcending the confines of a single generation. It's not merely concerning amassing significant assets; it's about creating financial security for future descendants. This ambition involves strategic planning that cultivate long-term abundance.

- One crucial element of generational wealth building is educating younger people about responsible spending.

- Investing wisely in resources that offer reliable returns is another cornerstone of this process.

- Furthermore, encouraging a environment of frugality within the unit is essential.

Ultimately, building generational wealth is about leaving behind a legacy that empowers future generations. It's a path that requires persistence but yields significant rewards.

Nurturing Wealth Accumulation Habits: The Path to Prosperity

Building wealth is a journey, not a aspiration. It requires commitment and Next-gen home security AI the development of healthy financial habits. By implementing positive habits, you can set yourself on the path to prosperity.

Start by creating a budget that monitors your income and expenses. Identify areas where you can minimize spending and direct those funds towards savings and investments.

Make saving a priority, even if it's just a small amount each month. Time value of money is your powerful tool when it comes to building wealth over time.

Consider familiarizing yourself with different investment options and spreading your portfolio to reduce risk.

Connect with a financial advisor if you need direction in developing a personalized wealth-building plan. Remember, steadfastness is key. Stay focused on your goals and make calculated financial actions.

Unveiling High-Yield Investments: Maximizing Your Earnings

In today's dynamic financial landscape, investors are constantly seeking avenues to boost their returns. High-yield investments present a compelling opportunity to attain substantial growth. These instruments, often characterized by higher risk profiles, offer the potential for impressive returns.

Nevertheless, navigating the realm of high-yield investments requires a calculated approach. Grasping the inherent risks and rewards associated with these instruments is essential. A well-diversified portfolio, coupled with meticulous research, can help mitigate potential downsides while maximizing your chances of achieving financial success.

- Assess investments that align with your risk tolerance and investment goals.

- Spread your portfolio across various asset classes to reduce exposure.

- Conduct due diligence on any investment before committing your capital.

Proven Strategies for Success

Wealth creation isn't merely a matter of divine providence. It's a calculated process grounded in proven principles and strategies that can be mastered by anyone willing to put in the effort. This article delves into the science behind wealth building, revealing actionable steps you can take to secure your financial future.

- Firstly, it's essential to cultivate a strong financial framework. This involves creating a budget, scrutinizing your expenses, and recognizing areas where you can optimize your spending habits.

- Next, consider investing in assets that have the potential to appreciate over time. This could include stocks, real estate, or alternative investments that align with your risk tolerance and financial goals.

- In conclusion, remember that wealth building is a long-term endeavor. It requires patience, consistency, and a willingness to evolve as market conditions change.

Financial Freedom Blueprint

Achieve financial stability by crafting your own strategy. This isn't about getting rich quick, but about establishing a structure for long-termsuccess. Our guide will equip you with the knowledge to take control. Start your journey towards freedom today!

- Define your objectives

- Implement a spending plan

- Invest your wealth

- Safeguard your finances

Jennifer Grey Then & Now!

Jennifer Grey Then & Now! Alicia Silverstone Then & Now!

Alicia Silverstone Then & Now! Barbi Benton Then & Now!

Barbi Benton Then & Now! Lucy Lawless Then & Now!

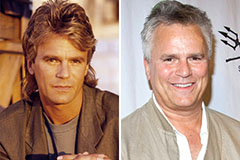

Lucy Lawless Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!